(1) | This column is comprised of shares of IBM common stock beneficially owned by the named person. Unless otherwise noted, voting power and investment power in the shares are exercisable solely by the named person, and none of the shares are pledged as security by the named person. Standard brokerage accounts may include nonnegotiable provisions regarding set-offs or similar rights. This column includes 135,267 shares in which voting and investment power are shared. The directors and officers included in the table disclaim beneficial ownership of shares beneficially owned by family members who reside in their households. The shares are reported in such cases on the presumption that the individual may share voting and/or investment power because of the family relationship. The shares reported in this column do not include 44,1602023.| | | | | | | | | | | | | | | | | Acquirable within 60 days | | | Value of

Common Stock

shares at

Fiscal Year End | | | | | | | Common | | | Stock-based | | | Options And | | | Directors’

DCEAP | | | | Name | | | Stock | (1) | | Holdings | (2) | | RSUs | (3) | | Shares | (4) | | ($) | (5) | | | Michelle H. Browdy | | | | | 119,442 | | | | | | 147,997 | | | | | | 30,898 | | | | | | N/A | | | | | | 19,534,739 | | | | | Marianne C. Brown(6) | | | | | 440(7) | | | | | | 440 | | | | | | 0 | | | | | | 119 | | | | | | 91,424 | | | | | Thomas Buberl | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 10,062 | | | | | | 1,645,640 | | | | | Gary D. Cohn | | | | | 52,958 | | | | | | 81,799 | | | | | | 45,162 | | | | | | N/A | | | | | | 8,661,281 | | | | | David N. Farr | | | | | 8,508(8) | | | | | | 8,508 | | | | | | 0 | | | | | | 19,438 | | | | | | 4,570,568 | | | | | Alex Gorsky | | | | | 4,444 | | | | | | 4,444 | | | | | | 0 | | | | | | 28,028 | | | | | | 5,310,796 | | | | | Michelle J. Howard | | | | | 144 | | | | | | 144 | | | | | | 0 | | | | | | 12,370 | | | | | | 2,046,665 | | | | | James J. Kavanaugh | | | | | 98,395(9) | | | | | | 148,834 | | | | | | 52,050 | | | | | | N/A | | | | | | 16,092,502 | | | | | Arvind Krishna | | | | | 307,431(10) | | | | | | 393,302 | | | | | | 84,150 | | | | | | N/A | | | | | | 50,280,340 | | | | | Andrew N. Liveris | | | | | 2,655 | | | | | | 2,655 | | | | | | 0 | | | | | | 37,598 | | | | | | 6,583,378 | | | | | F. William McNabb III | | | | | 9,250 | | | | | | 9,250 | | | | | | 0 | | | | | | 11,764 | | | | | | 3,436,840 | | | | | Michael Miebach(6) | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 363 | | | | | | 59,369 | | | | | Martha E. Pollack | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 13,998 | | | | | | 2,289,373 | | | | | Joseph R. Swedish | | | | | 5,261(11) | | | | | | 5,261 | | | | | | 0 | | | | | | 13,906 | | | | | | 3,134,763 | | | | | Robert D. Thomas | | | | | 33,482(12) | | | | | | 101,177 | | | | | | 64,896 | | | | | | N/A | | | | | | 5,475,981 | | | | | Peter R. Voser | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 26,414 | | | | | | 4,320,010 | | | | | Frederick H. Waddell | | | | | 3,763 | | | | | | 3,763 | | | | | | 0 | | | | | | 18,564 | | | | | | 3,651,581 | | | | | Alfred W. Zollar | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 5,637 | | | | | | 921,931 | | | | | Directors and executive officers as a group | | | | | 674,703(13) | | | | | | 961,796 | | | | | | 302,662(13) | | | | | | 198,261(13) | | | | | | 142,773,263 | | |

(1)

This column is comprised of shares of IBM common stock beneficially owned by the named person. Unless otherwise noted, voting power and investment power in the shares are exercisable solely by the named person, and none of the shares are pledged as security by the named person. Standard brokerage accounts may include nonnegotiable provisions regarding set-offs or similar rights. This column includes 186,396 shares in which voting and investment power are shared. The directors and officers included in the table disclaim beneficial ownership of shares beneficially owned by family members who reside in their households. The shares are reported in such cases on the presumption that the individual may share voting and/or investment power because of the family relationship. The shares reported in this column do not include 6,807 shares held by the IBM Personal Pension Plan Trust Fund, over which the members of the IBM Retirement Plans Committee, a management committee presently consisting of certain executive officers of the Company, have voting power, as well as the right to acquire investment power by withdrawing authority now delegated to various investment managers. (2)

For executive officers, this column is comprised of the shares shown in the “Common Stock” column and, as applicable, all restricted stock units including retention restricted stock units, officer contributions into the IBM Stock Fund under the IBM Excess Savings Plan, and Company contributions into the IBM Stock Fund under the Excess Savings Plan. Some of these restricted stock units may have been deferred under the Excess Savings Plan in accordance with elections made prior to January 1, 2008, and they will be distributed to the executive officers after termination of employment as described in the 2023 Nonqualified Deferred Compensation Narrative. (3)

For executive officers, this column is comprised of (i) shares that can be purchased under an IBM stock option plan within 60 days after December 31, 2023, and (ii) RSU awards that vest within 60 days after December 31, 2023. For Ms. Browdy, Mr. Cohn, Mr. Kavanaugh, Mr. Krishna, and Mr. Thomas, shares in this column are from IBM restricted stock awards which will vest within 60 days after December 31, 2023. (4)

Promised Fee Shares earned and accrued under the IBM Deferred Compensation and Equity Award Plan (DCEAP) as of December 31, 2023, including dividend equivalents credited with respect to such shares. Upon a director’s retirement, these shares are payable in cash or stock at the director’s choice (see Director Compensation section for additional information). (5)

Values in this column are calculated by multiplying the number of shares shown in the “Common Stock” column plus the “Directors’ DCEAP Shares” column by the closing price of IBM common stock on the New York Stock Exchange on the last business day of the 2023 fiscal year ($163.55). (6)

Ms. Brown joined the Board in December 2023 and Mr. Miebach joined the Board in October 2023. (7)

Voting and investment power are shared. (8)

Includes 450 shares in which voting and investment power are shared. (9)

Includes 11,061 shares in which voting and investment power are shared. (10)

Includes 169,145 shares in which voting and investment power are shared. (11)

Voting and investment power are shared. (12)

Includes 39 shares in which voting and investment power are shared. (13)

The total of these three columns represents less than 1% of IBM’s outstanding shares, and no individual’s beneficial holdings totaled more than 1/20 of 1% of IBM’s outstanding shares. 282024 Notice of Annual Meeting & Proxy Statement | Ownership of Securities

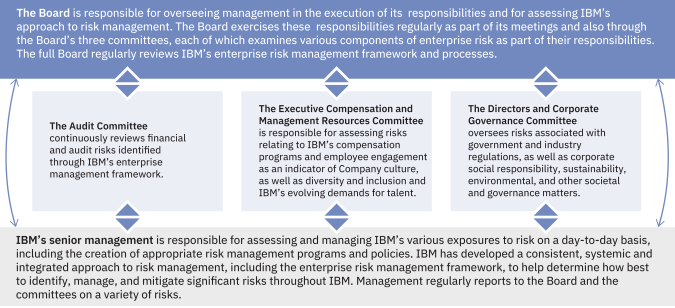

IBM Impact We believe IBM is a catalyst that makes the world work better. We aspire to make a lasting, positive impact in business ethics, our environment, and the communities in which we work and live. The IBM approach is embodied in the three pillars of our IBM Impact framework. It is informed through collaboration and engagement with a broad range of stakeholders and considers frameworks and initiatives such as the Global Reporting Initiative Standards, the Sustainability Accounting Standards Board Standards, the Task Force on Climate-Related Financial Disclosures, and the United Nations Sustainable Development Goals. Our latest Impact Report is available at https://www.ibm.com/impact/reports-and-policies. IBM Impact Framework | | Ethical Impact![[MISSING IMAGE: ic_ethicalimpact-pn.jpg]](/files/DEF 14A/0001104659-24-032641/ic_ethicalimpact-pn.jpg) | | | Equitable Impact ![[MISSING IMAGE: ic_equitableimpact-pn.jpg]](/files/DEF 14A/0001104659-24-032641/ic_equitableimpact-pn.jpg) | | | Environmental Impact ![[MISSING IMAGE: ic_environmentalimpact-pn.jpg]](/files/DEF 14A/0001104659-24-032641/ic_environmentalimpact-pn.jpg) | | | | Creating innovations, policies and practices that prioritize ethics, trust, transparency, and above all — accountability | | | Creating spaces and opportunities for everyone by focusing on diversity, equity, and inclusivity within IBM as well as the rightglobally | | | Creating better pathways to acquire investment power by withdrawing authority now delegated to various investment managers. |

(2)conserve natural resources, reduce pollution, and minimize climate-related risks | For executive officers, this column is comprised of the shares shown in the “Common Stock” column and, as applicable, all restricted stock units including retention restricted stock units, a retention performance share unit award, officer contributions into the IBM Stock Fund under the IBM Excess 401(k) Plus Plan, and Company contributions into the IBM Stock Fund under the Excess 401(k) Plus Plan. Some of these restricted stock units may have been deferred under the Excess 401(k) Plus Plan in accordance with elections made prior to January 1, 2008, and they will be distributed to the executive officers after termination of employment as described in the 2020 Nonqualified Deferred Compensation Narrative.

|

(3) | For executive officers, this column is comprised of (i) shares that can be purchased under an IBM stock option plan within 60 days after December 31, 2020, and (ii) RSU awards that vest within 60 days after December 31, 2020. For Mrs. Rometty, shares in this column are from a premium-priced option grant that can be purchased pursuant to an IBM stock option plan within 60 days after December 31, 2020. For Mr. Whitehurst, shares in this column are from a Red Hat restricted stock award that was converted pursuant to the Red Hat merger agreement into an IBM restricted stock award which will vest within 60 days after December 31, 2020.

|

(4) | Promised Fee Shares earned and accrued under the IBM Deferred Compensation and Equity Award Plan (DCEAP) as of December 31, 2020, including dividend equivalents credited with respect to such shares. Upon a director’s retirement, these shares are payable in cash or stock at the director’s choice (see 2020 Director Compensation Narrative for additional information).

|

(5) | Values in this column are calculated by multiplying the number of shares shown in the “Common Stock” column plus the “Directors’ DCEAP Shares” column by the closing price of IBM stock on the last business day of the 2020 fiscal year ($125.88).

|

(6) | Includes 450 shares in which voting and investment power are shared.

|

(7) | Includes 15,174 shares in which voting and investment power are shared.

|

(8) | Includes 49,128 shares in which voting and investment power are shared.

|

(9) | Includes 65,253 shares in which voting and investment power are shared.

|

(10) | Voting and investment power are shared.

|

(11) | The total of these three columns represents less than 1% of IBM’s outstanding shares, and no individual’s beneficial holdings totaled more than 1/4 of 1% of IBM’s outstanding shares.

|

| | | 26 | | 2021 Notice of Annual Meeting & Proxy Statement | Ownership of Securities |

Environmental Ethical Impact

IBM is committed to developing policies and Social ResponsibilityCorporate social responsibilitypractices that prioritize ethics, trust, transparency, and accountability. For over a century, IBM has been a hallmarkearned the trust of IBM’s culture for over 100 years. With oversight fromour clients by responsibly managing their data. We earn the Board, we have long embraced a corporate philosophy that is inclusivetrust of all our stakeholders – from our customers, employees, suppliers and stockholders, to our communities andby ushering powerful new technologies into the world, around us. Eachethically and with purpose. We believe it is our responsibility to continue to contribute to diverse, global efforts that shape standards and best practices for current and emerging technologies, such as AI.

Putting our Principles of those stakeholdersTrust and Transparency into Practice IBM’s Principles for Trust and Transparency are the guiding values that distinguish IBM’s approach to AI ethics. They include: •

The purpose of AI is increasingly focusedto augment human intelligence; •

Data and insights belong to their creator; and •

New technology, including AI systems, must be transparent and explainable. These principles are supported by five pillars of trust that IBM developed to guide the responsible adoption of AI technologies: explainability, fairness, robustness, transparency and privacy. The IBM AI Ethics Board is actively engaged in supporting alignment with these principles and pillars to address generative AI and has published a white paper on environmental, socialthe opportunities, risks and governance, or “ESG,” practices and how they impact the Company and society. Our world-class governance practices are set out above in this Proxy Statement. In addition,mitigations for foundation models (https://www.ibm.com/impact/ai-ethics). IBM’s leadership in environmentalAI ethics in reflected in many external collaborations, including the Notre Dame — IBM Technology Ethics Lab, which in 2023 focused on the challenges of auditing AI systems and social responsibilityin 2024 will explore the ethical issues of foundation models in enterprises, among other projects. IBM also launched the AI Alliance, a group of leading organizations across industry, startup, academia, research and government coming together to support open innovation and open science in AI. The AI Alliance is focused on fostering an integral part of our long-term performance strategy,open community and we continueenabling developers and researchers to take bold actions that build upon our legacy ofaccelerate responsible stewardship.We encourage stockholdersinnovation in AI while ensuring scientific rigor, trust, safety, security, diversity and economic competitiveness, and IBM is proud to read our annual Corporate Responsibility Report which provides deep insight into all of our ESG initiatives and more, includingbe a mapping of key ESG metricsfounding member to SASB, and is available at: https://www.ibm.org/responsibility/reports. Based on feedback from our investor outreach, below we also provide some examples reflecting how we are:

Working to protect our environment for future generations.

Managing the historic challenges presented by COVID-19.

Embracing a diverse and inclusive workforce.

Being a responsible steward of technology.

Advocating for responsible public policy positions.

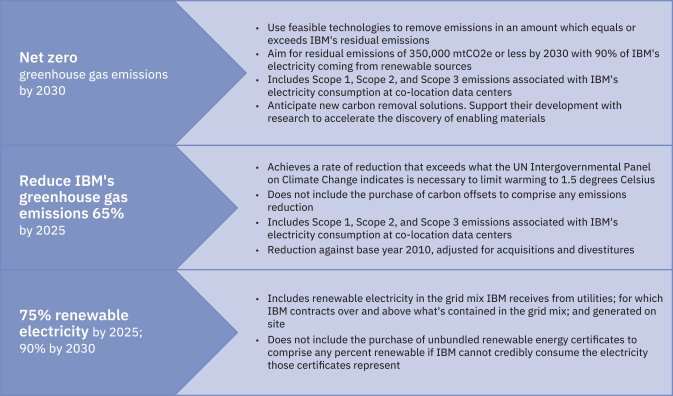

Protecting the Environment

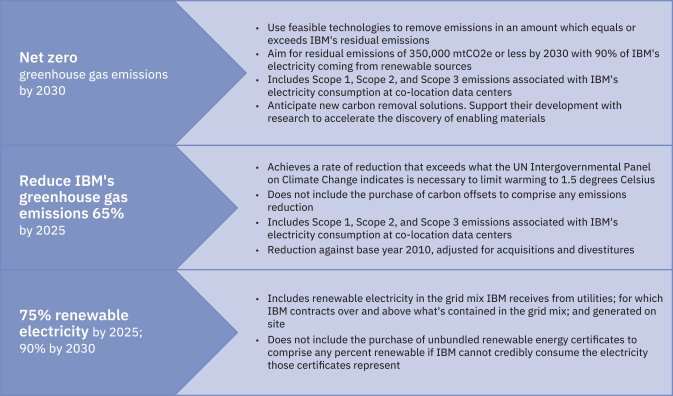

In 2021, following record progress toward our renewable electricity and greenhouse gas emissions goals, IBM set next generation goals to continue our leadershiplead in sustainability. Notably, IBM now aims to reach net zero greenhouse gas emissions by 2030.

| For the past 30 consecutive years, IBM has voluntarily published its IBM and the Environment Report providing detailed information on our environmental programs and performance. IBM’s uninterrupted annual publication of this report since 1990 is unsurpassed across our industry. The most recent IBM and the Environment Report is available at https://www.ibm.com/ibm/environment/annual/reporting.shtml. You can also review IBM’s comprehensive contributions to the U.N. Sustainable Development Goals at https://files.ibm.org/responsibility/thought-leadership/pdfs/IBM_and_the_UN_Sustainable_Development_Goals.pdf.

|

this space.

| | | 2021 Notice of Annual Meeting & Proxy Statement | Environmental and Social Responsibility | | 27 |

Responding to COVID-19

The COVID-19 pandemic has brought challenges unlike any seen in

By providing an inclusive environment that encourages learning and exploration of new ideas and innovative approaches, we can make the moderngreatest impact with our clients, partners, colleagues, and the world. Our response has been guidedFostering a culture underpinned by four principles: (1) employee, clientour purpose, values, and community healthgrowth behaviors is top priority; (2) our plan and response must be data-driven and evidence-based; (3) we will comply with all government requirements; and (4) focus on business continuity and maintaining critical operations. At the outset, IBM immediately mobilized to move nearly all of our ~350,000what drives us. It’s what motivates employees to work remotely within two weeks and established resources for maintaining employee engagement, productivity and emotional support. We also assembled our resources and brought togetherdo their best work. Together, we think big, set the right communities of experts, including clients, governments, scientists, developers, partners, academic institutions, health agencies and IBMers, to work together and manage through the COVID-19 outbreak by doing what IBM does best: applying data, knowledge, computing power and insights to solve difficult problems. | Supporting our Communities During the Pandemic

| ✓ Spearheaded the COVID-19 High Performance Computing Consortium with the White House Office of Science and Technology Policy and the U.S. Department of Energy to provide access to the world’s most powerful high-performance computing resources in support of COVID-19 research

✓ Committed $200M in technology, services, and money to COVID-19 response efforts including to aid healthcare scientists, researchers, and educators

✓ Created precise incident mapping

✓ Raised funds for first responders and hospital workers

✓ Provided 300,000 New York students with equipment they need for online lessons

|

Supporting the IBMer

At IBM, our global workforce is highly skilled, reflective of the work we dopace for our clients’ digital transformationsindustry, forge partnerships, and in support of their mission-critical operations. We are passionately dedicated to our employees’ professional growthmake the world work better.

Embracing and personal well-being, investing in resources to help IBMers develop their skillsEnabling a Diverse and leadership potential, and building on IBM’s legacy of leading the market in welcoming and supporting a diverse, inclusive workforce. | | | | | Talent and Culture

| | Diversity and Inclusion

| | Health and Safety

| • IBM offers a compelling value proposition to employees: IBMers develop innovative technologies including Cloud, AI, quantum computing and cybersecurity, for clients whose businesses the world relies on

• 9 out of 10 IBMers have acquired strategic skills with IBMers completing more than 80 hours of learning per person in 2020

• Hundreds of thousands of IBMers globally participate in our annual engagement survey, with workforce engagement up more than 2 points year to year

• Every IBM manager and leader has access to their team and organization engagement levels along with actionable data-driven insights

• Attrition levels in 2020 were below the prior 5-year average

| | • We seek to ensure IBMers from diverse backgrounds are engaged, feel supported to be their authentic selves, build skills, and achieve their greatest potential

• IBM’s Board of Directors recently adopted a policy to commit IBM to annually publish a report assessing the Company’s diversity, equity and inclusion efforts and programs

• 9 out of 10 IBMers say they can be their authentic selves at work

• More than 33% IBMers identify as women

• Engagement was up year to year for women, Black and Hispanic IBMers

• IBM has had an equal pay policy since 1935; we have conducted statistical pay equity analysis for decades, and in 2020 this included all countries where we have employees

| | • We have a long-standing commitment to the health, safety and well-being of our employees

• Early in the course of the COVID-19 outbreak, we restricted travel, cancelled meetings and events, and prepared nearly 95% of our workforce to work from home

• Our robust case management system manages COVID-19 exposures

• Our comprehensive playbook on workplace health and safety measures will allow locations to reopen when pandemic conditions improve

• Employees are supported with 24/7 access to IBM’s world-class Health and Safety team for questions and concerns, education and bidirectional, timely and targeted communications

|

Inclusive Workforce | | | 28 | | 2021 Notice of Annual Meeting & Proxy Statement | Environmental and Social Responsibility |

| | | IBM continues to invest in skills and

re-skilling to make the digital era more inclusive

| | • P-TECH, our high school to career model focuses on students of color and educationally underserved students; P-TECH now spans 243 schools and 600 industry partners across 28 countries

• IBM’s “returnship” and apprenticeship programs create opportunities for hundreds of new IBMers

• Open P-TECH, our platform providing free online learning for students ages 14-20 on emerging technologies and professional competencies, has more than 224,000 users

• SkillsBuild, our platform providing free online learning for adults in need of skilling and reskilling, now serves more than 122,000 users globally

|

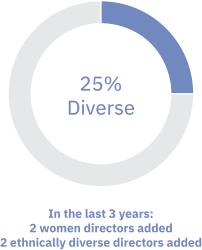

The IBM Board’s Commitment to Diversity and Inclusion

The IBM Board of Directors strongly believes that much of theIBM’s future success of IBM depends on the caliber of its talent and the full engagement and inclusion of IBMers in the workplace. A diverseWe foster a culture of conscious inclusion and inclusive workplace leadsactive allyship where IBMers can make a positive impact on society and bring their authentic selves to greater innovation, agility, performance and engagement, enabling both business growth and societal impact. In furtherance of this mission,work. IBM has had an equal pay policy since 1935. We have conducted statistical pay equity analyses for decades, and in response2023 we continued this practice for all countries where we have employees. 2024 Notice of Annual Meeting & Proxy Statement | IBM Impact 29

Supporting our Employees IBM offers a competitive benefits program, designed to help employees build a solid foundation for meeting a diverse array of needs — health care, income protection, retirement security, and personal interests. IBMers worldwide have confidential, 24/7 access to critical mental health support through employee assistance programs and supplemental resources. Other programs include training for employees on resilience, ergonomics, and financial well-being. IBM is actively fostering an environment of growth, inclusion, innovation, and feedback. We support our employees’ professional development by investing in a range of advanced tools and resources that empower IBMers to direct their own career paths and build the skills required to pursue their goals. IBMers globally participate in our annual engagement with our stockholders, thesurvey, providing actionable, data-driven insights on workplace experience, inclusion, pride and propensity to recommend IBM Board formally adopted a policy committing the Company to report annually on the effectivenessas an employer. In 2023, more than 8 of our diversity and inclusion programs. IBM will publish a diversity and inclusion report10 IBMers who participated in the second quarter of 2021. Furthermore,survey responded that they felt engaged at work — a testament to our industry-leading talent practices. Community Development At IBM, we believe we have a shared commitment to create a better, more equitable world — for each other, and within our global community. We are expanding access to digital skills and employment opportunities so that more people — regardless of their background — can participate in the digital economy. In 2023, IBM committed to publish EEO-1 datatrain two million learners in 2022 afterAI by the completionend of 2026, with a focus on underrepresented communities. To achieve this goal at a global scale, we are expanding our collaborations with universities and partners to deliver AI training to adult learners and are launching new generative AI coursework through IBM SkillsBuild. Closing the Company’s spin-offskills gap is one of its managed infrastructure services business. | | | | |  | | IBM’s Be Equal employee pledge campaign champions diversity and inclusion for everyone, driving systemic, sustainable improvement for people in every community. Since its launch in 2019, tens of thousands of individuals worldwide have pledged their commitment to equal representation.

| | • Be Vocal

• Be Plural

• Be Active

• Be Supportive

• Be Progressive

|

Operating with Trust and Transparency

IBM’s top priorities in this space. We are taking bold action to achieve this. For more than 10050 years, IBM has continuously strived for responsible innovation capablebeen committed to environmental responsibility — a commitment formalized by our first corporate environmental policy in 1971, which integrated environmental responsibility throughout the fabric of bringing benefitsour business. IBM views environmental leadership as a long-term strategic imperative, demonstrated today as we continue to everyoneset ambitious goals and not just a few. This philosophy is also appliedapply our technologies to artificial intelligence:accelerate solutions to global environmental challenges. Enabling Our Clients and Communities At IBM, we aim to createhelp clients and offer reliable technologycommunities achieve their sustainability goals by infusing trustworthy data with AI into daily operations enabled by expertise that can augment, not replace, human decision-making. Properly calibrated,operationalize sustainability to combat climate change. Enabling Our Clients: IBM’s sustainability technology, consulting and research capabilities make data visible and actionable. By leveraging AI can assist humans in making fairer choices, countering human biases, and promoting inclusivity.automation for scale and speed across functions, we accelerate clients’ business objectives and sustainability goals, increase productivity, reduce costs, waste and emissions — and help them meet regulatory requirements. Enabling Our Communities: Through programs like the IBM recognized early that clearly articulating principlesSustainability Accelerator, IBM addresses multiple environmental threats around the ethical deploymentworld. The program applies IBM technologies, such as watsonx, and an ecosystem of AI technologies was critical — backed byexperts to enhance and scale non-profit and government organization initiatives helping populations especially vulnerable to environmental threats. The program selects five projects around a strong commitment to putting words into practice. Our commitmenttheme every year. Currently, the IBM Sustainability Accelerator has three active cohorts: the first is represented by our long-standing values, our Trust and Transparency Principles, and several recent developments: IBM signedfocused on sustainable agriculture, the Vatican’s Rome Call for AI Ethics, created the Notre Dame-IBM Technology Ethics Lab, published our Points of Viewsecond on Facial Recognitionclean energy, and the Precision Regulationthird on water management. In 2024, we plan to deploy a fourth cohort focused on advancing resilient cities. 302024 Notice of AI, donated our AI Explainability 360 Toolkit as an open source resource, and contributed to the EU High-Level Expert Group’s Guidelines for Trustworthy AI.While continuing to collaborate with governments, companies and other organizations, we also embraced the need for an internal governance framework and process to evaluate opportunities based on well-defined guidance around privacy and security. We established an internal AI Ethics Board to work with experts through our business to centralize the assessment of more complicated questions. The board is comprised of a cross-disciplinary team of senior IBMers, co-chaired by IBM’s Chief Privacy Officer and AI Ethics Global Leader, and reports to the highest levels of the Company.

| | | | | The Purpose of AI

| | Data Insights and Ownership

| | Transparency and Explainability

| | | |

| |

| |

| The purpose of AI is to augment human intelligence. At IBM, we believe AI should make all of us better at our jobs, and that the benefits of the AI era should touch the many.

| | Data and insights belong to their creator. IBM clients’ data is their data, and their insights are their insights.

| | New technology, including AI systems, must be transparent and explainable. Technology companies must be clear about who trains their AI systems, what data was used in that training and, most importantly, what went into their algorithms’ recommendations.

|

Annual Meeting & Proxy Statement | IBM Impact

| | | 2021 Notice of Annual Meeting & Proxy Statement | Environmental and Social Responsibility | | 29 |

Responsibly Advocating Public Policy IBM’s Government and Regulatory Affairs team engages in worldwide policy advocacy to drive growth and innovation in the digital economy.IBM has never had a political action committee (PAC), makes no political donations, and has always been committed to meaningful management, oversight, and accurate reporting of our engagement with government officials. To be clear, these policies do not putThrough deep expertise in specific areas of public policy relevant to its business, clients and communities, IBM at a disadvantage — instead, they empower usworks collaboratively with governments worldwide to promote meaningful policies that are good for business, employees,expand economic prosperity and all our stakeholders. Overadvance the past year, while America’s democratic institutions were tested and manyability of IBM’s corporate peers contemplated suspending financial contributionspowerful technologies to certain elected officials, we faced no such quandary. Consistent with our long-held principles, IBM was able to stay focusedhave positive impacts on substantive policy issues. society. | | | | | Political Contributions | |

| | |

| | Political Contributions:IBM engages in policy, not politics. In 1968, former IBM CEO Thomas Watson Jr. said a company “should not try to function as a political organization in any way.” IBM continues to live by this philosophy to this day. We have a long-standing policy not to make contributions of any kind (money, employee time, goods or services), directly or indirectly, to political parties or candidates, including through intermediary organizations, such as PACs, campaign funds, or trade or industry associations. This policy applies equally in all countries and across all levels of government, even where such contributionsgovernment. Our approach to advocacy is also grounded in a commitment to preserve and strengthen trust in civic institutions and, to that end, we have partnered with other leading companies and the University of Michigan’s Erb Institute to build and advance a set of principles to promote Corporate Political Responsibility (CPR). By sharing the merit of our non-giving advocacy strategy and deepening business engagement with the CPR principles, we work to increase transparency in the ways that corporations advocate on public policy issues. These principles are permitted by law. In short, IBM engagesfocused on strengthening trust in civic institutions and their interactions with business, and providing a framework for how business can responsibly influence public policy not politics.

without giving a dime to political candidates or campaigns. | |

IBM does not have a PAC and does not engage in independent expenditures or electioneering communications as defined by law.

| | | | Lobbying | |

| | | | | |

| | Lobbying:IBM’s Government and Regulatory Affairs team is committed to advancing common sense public policies that benefit our business and communities. We seek to build trust in technology through precision regulation, a modernized digital infrastructure, promoting justice and equality for all citizens, and leveraging science and technology for good, including in the global fight against COVID-19.good. All IBM lobbying activities, including by third parties on behalf of IBM, require the prior approval of the IBM Office of Government and Regulatory Affairs and must comply with applicable law and IBM’s Business Conduct Guidelines.

| IBM files periodic reports with the Secretary of the U.S. Senate and the Clerk of the U.S. House of Representatives detailing its U.S. federal lobbying activities and expenditures, with U.S. state and municipal governments, where required, and with the European Union Transparency Register. | |

| | |

| | Trade Associations:

IBM joins trade and industry associations that add value to IBM, its stockholders and employees. These groups have many members from a wide variety of industries, and cover broad sets of public policy and industry issues. Although IBM works to make our voice heard, there may be occasions where our views on an issue differ from those of a particular association. | We perform comprehensive due diligence on all of our trade associations to confirm they are reputable and have no history of malfeasance. Company policy prohibits them from using any IBM funds to engage in political expenditures, and we implement robust procedures to ensure they comply. Please visit https://www.ibm.com/policy/philosophy-and-governance-new/ for a list of the trade associations that we support, through annual payments of $50,000 or higher, that are directly engaged in U. S. lobbying. | | | | | The IBM Board of Directors, as part of its oversight function, periodically receives reports from senior management relating to IBM’s policies and practices regarding governmental relations, public policy, and any associated expenditures. | | | | | IBM’s senior management, under the leadership of IBM Government and Regulatory Affairs, closely monitors and coordinates all public policy advocacy efforts, as well as any lobbying activities. | |

| | IBM is proud to report that the Center for Political Accountability’s 20202023 Report on Corporate Political Disclosure and Accountability gave IBM a score of 98.6 out of 100, naming IBM a trendsetter in Political Disclosure and Accountability and recognizing IBM as one of only 2620 companies that fully prohibit the use of corporate assets to influence elections and as one of only 38 companies that prohibit both trade associations and non-profits from using Company contributions for election-related purposes. |

| | | | | | | | | Advocating on Social Justice

| Police Reform

Advocating for new federal rules that hold police more accountable for misconduct

| | Responsible Use of Technology

Condemning the contributions of technology to discrimination or racial injustice

| | Broadening Opportunities

Providing training and education for in-demand skills, to expand economic opportunity for communities of color

| | LGBT+ Rights

Fighting for LGBT+ workplace equality since 1984, when IBM first included sexual orientation in its equal opportunity policy

| | Immigration Reform

Standing with Dreamers and protecting the vital role that immigrants have always played in this country

|

IBM’s policies and practices with regard to public policy matters, including lobbying activities and expenditures, are available on its website: https://www.ibm.com/policy/government-regulatory-affairs/philosophy-governance/.

| | | 30 | | 2021 Notice of Annual Meeting & Proxy Statement | Environmental and Social Responsibility |

2024 Notice of Annual Meeting & Proxy Statement | IBM Impact 31

2023 Executive Compensation Report of the Executive Compensation andManagement Resources Committee of the Board of Directors Set out below is the Compensation Discussion and Analysis, which is a discussion of IBM’s executive compensation programs and policies written from the perspective of how we and management view and use such programs and policies. Given the Committee’s role in providing oversight to the design of those programs and policies, and in making specific compensation decisions for senior executives using those programs and policies, the Committee participated in the preparation of the Compensation Discussion and Analysis, reviewing successive drafts of the document and discussing those with management. The Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement. We continue to evaluate the effectiveness of our executive compensation programs and practices, and a critical component of that evaluation process is feedback from engaging with our stockholders. We appreciate all of the feedback and support, and we join with management in welcoming readers to examine our pay practices and in affirming the commitment of these pay practices to the long-term interests of stockholders.Alex Gorsky

Frederick H. Waddell(chair)Andrew N. Liveris

Joseph R. Swedish

Martha E. Pollack

Thomas Buberl

| | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Executive Compensation | | 31 |

322024 Notice of Annual Meeting & Proxy Statement | 2023 Executive Compensation

2023 Compensation Discussion and AnalysisExecutive Summary

Compensation

| | In 2023, IBM

delivered $61.9B in revenue, $11.2B of free cash flow, and

generated $13.9B in cash from operations. | | | | | | Revenue Generation Revenue year-to-year growth figures at constant currency.(1) | |

| Optimized Portfolio Positioned to Deliver High Value | | | | | | Recurring Revenue Acceleration | | | IBM continues to strengthen and reinforce its position in delivering high-value, differentiated technology to its clients | | | | | | About 50% of IBM revenue is recurring, with a high-value mix | |

| | 2023 Revenue Mix | | | 2023 Recurring Revenue Mix | | | | | | | Increased revenue mix due to higher growth Software and Consulting Software revenue grew 5% year-to-year Hybrid Platform & Solutions +5% year-to-year, including Red Hat +9% year-to-year Consulting revenue grew 6% year-to-year Broad-based growth across all business lines and geographies reflecting the strength of our consulting expertise and offerings | | | | | | 67% of recurring revenue now comes from high-growth Software Hybrid Platform & Solutions exited 2023 with over $14 billion in Annual Recurring Revenue(1) | |

Revenue year-to-year growth figures at constant currency.(1) Strategic Capital Allocation | | Completed 9 acquisitions

in 2023 for $5B, and invested nearly $7B in RD&E | | | | Returned $6B to stockholders

through dividends in 2023 | | | | Ended 2023 with $13.5B in cash and marketable securities, up over

$4.6B year-to-year | |

(1)

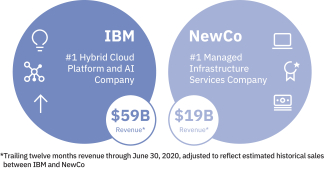

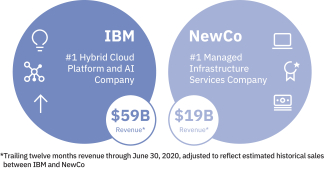

Non-GAAP financial metrics. See Appendix A for information is disclosed in this Proxy statement for both Mr. Krishna and Mrs. Rometty. Mr. Krishna succeeded Mrs. Rometty as Chief Executive Officer on April 6, 2020. He assumed the Chairman’s role beginning January 1, 2021. Mrs. Rometty was Executive Chairman until December 31, 2020, when she retired from the Company.IBM’s Strategic Pivot to Growth

Over the last several years, IBM has built the foundation to capitalize on the $1 trillion hybrid cloud market opportunity, accelerated with the 2019 acquisition of Red Hat that established IBM as the market-leading hybrid cloud platform. In 2020, IBM took further decisive action to redefine the future of the company and create value through focus. In October 2020, the Company announced the spin-off of the managed infrastructure services business, which will immediately be the market leader at twice the size of its nearest competitor.

As discussed with investors, the pending spin-off will enable IBM to focus on delivering sustainable growth as a hybrid cloud and AI company. This also represents a shift in the Company’s business model where the majority of revenue will now come from software and solutions, enabling acceleratedhow we calculate these performance metrics.

(2)

Year-to-Year revenue growth post separation. To realize this strategy, IBM is undertaking a number% includes incremental sales to Kyndryl (post-separation, through October 2022) of actions associated with the spin-off~1 point and the growth of the hybrid cloud business. These include structural~4 points for 2021 and transaction-related actions enabling the separation and ongoing competitiveness of the managed infrastructure services business, as well as increased reinvestment in the hybrid cloud platform. The Company plans to increase investment in innovation, skills expertise and ecosystems including targeted acquisitions to accelerate IBM’s hybrid cloud platform growth strategy.To reinforce the strategic shift, we revamped our executive compensation programs to ensure alignment with IBM’s growth strategy and investor expectations. The following comprehensive changes have been made to support this growth prioritization:

The 2021 Annual Incentive Program has been updated to include two metrics, Total IBM Revenue and Operating Cash Flow, each at equal weight. The equal weighting of both metrics emphasizes the revenue growth and cash generation necessary to support increased investment and stockholder return.

The Long-term Incentive Plan has been updated to introduce Total IBM Revenue at a 40% weighting along with a corresponding reduction to the Operating EPS metric from 70% to 30%, while maintaining Free Cash Flow at a 30% weight. This design change places further emphasis on revenue growth as the key driver for the Company’s success over the long-term.

Throughout IBM’s 110-year history, diversity and inclusion has been intrinsic to our corporate culture. The company believes growth and success can only be achieved by fostering a climate that values and seeks out diversity. In order to affirm management’s commitment to improving a diverse representation of our workforce, a modifier will be introduced to the Annual Incentive Program, providing a potential positive or negative adjustment to the AIP score depending on progress in diversity representation.

Given the importance of the next two years on executing the Company’s strategic shift to growth, on February 23, 2021 the Committee approved changes to the 2019-2021 and 2020-2022 Performance Share Unit targets incorporating the impact of the planned 2021 spin-off of the managed infrastructure services business, along with actions taken to enable the separation of NewCo and enable IBM’s growth strategy under current market conditions. Consistent with the Company’s long-standing practice of setting rigorous performance plans, cumulative targets for both plans remain higher than comparable metrics shared with investors on January 21, 2021.

The impacts of these significant strategic decisions on the Company’s executive compensation programs are discussed in the following Compensation Discussion and Analysis.

2022, respectively. | | | 32 | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis |

| In 2020, IBM delivered $73.6B in revenue, with a 48.3% gross profit margin, and generated $18.2B cash from operations.

|

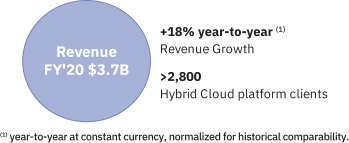

Hybrid Cloud Platform Performance

IBM Cloud Revenue

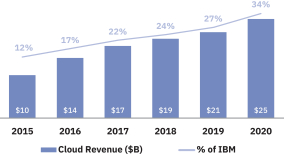

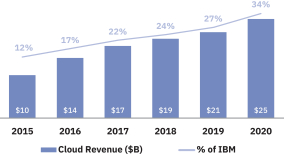

Over $25B total Cloud revenue, more than doubling since 2015, and now making up over 34% of IBM revenue.

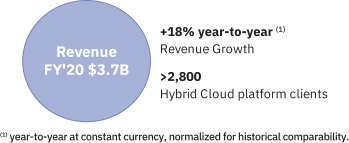

Red Hat Growth

Red Hat continued its momentum, with strong double-digit revenue growth(1).

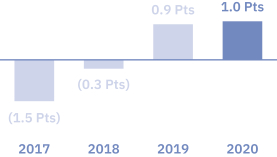

Year-to-Year Gross Margin

Expanded gross margin, with continued shift to higher value and improved services productivity.

Establishing two Market-Leading Companies

Announced separation of the managed infrastructure services business into a new $19B* market-leading public company.

Strong Cash Generation And Strategic Capital Allocation

| | | | | | | | | Generated $10.8B

Free Cash Flow(1), with

196% realization(2) | | | | Return on

Invested Capital (ROIC)

14.5%(1, 3)

| | | | Returned $5.8B to

stockholders;

reduced debt by ~$11.5B

since June 2019 peak

|

(1) | Non-GAAP financial metrics. See Appendix A for information on how we calculate these performance metrics.

|

(2) | 143% excluding $2B charge for 4Q 2020 structural action. See Appendix A for information on how we calculate this performance metric.

|

(3) | ROIC equals net operating profits after tax (GAAP net income from continuing operations plus after-tax interest expense) divided by the sum of the average debt and average total stockholders’ equity. It is computed excluding current period U.S. Tax reform charges and goodwill associated with the Red Hat acquisition.

|

Note: In an effort to provide additional and useful information regarding IBM’s financial results and other financial information as determined by generally accepted accounting principles (GAAP), this Compensation Discussion and Analysis and Proxy Statement contains certain non-GAAP financial measures, on a continuing operations basis, including operating earnings per share, free cash flow, consolidated operating cash flow, operating net income from continuing operations, revenue for Red Hat normalized for historical comparability,and revenue growth rates adjusted for currency, revenue adjusted for divested businesses and currency, and ROIC.currency. Amounts are presented on a continuing operations basis unless otherwise noted. For reconciliation and rationale for management’s use of this non-GAAP information, refer to Appendix A — “Non-GAAPNon-GAAP Financial Information and Reconciliations.”

| | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis | | 33 |

2024 Notice of Annual Meeting & Proxy Statement | 2023 Compensation Discussion and Analysis 33

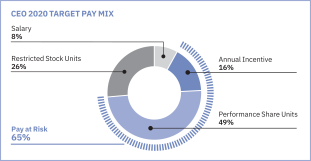

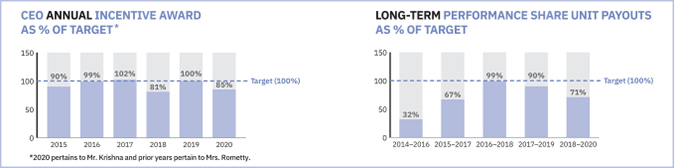

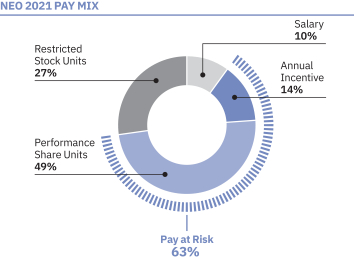

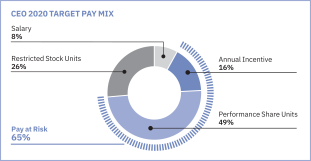

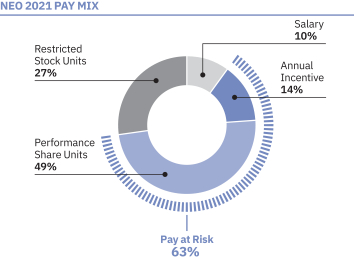

Our compensation strategy, with significant pay at risk, supports the drivers of IBM’s high value business model. For 2020,2023, at target, 65% approximately 77% of Mr. Krishna’s pay effective April 6, 2020 (when he became CEO) wasremained at risk and subject to attainment of rigorous performance goals. | | | | For 20202023 performance, the Board approved an annual incentive payment of $2,181,000$3,510,000 for Mr. Krishna, 85%which was 117% of target. The payout reflects a 100% Individual Contribution Factor (ICF) and the Annual Incentive Program (AIP) pool funding at 85%117%.

| |  | | |

In making this award in line with the Company’s incentive score, the Committee also considered Mr. Krishna’s overall performance against his objectives, which included positioningstrong free cash flow generation, sustainable revenue generation (at constant currency), and the Company for sustainable growth as a hybrid cloud and AI company by announcing the spin-offcontinued optimization of the Company’s managed infrastructure business.portfolio, with an increased mix of higher growth software and consulting revenue. In addition, the Committee considered hisMr. Krishna’s personal leadership in continuing IBM’s leadership inAI and quantum computing, increasing diversity representation across all areas, and recorddriving IBM’s high performance culture, as well as continued best in class employee engagement in a challenging environment.engagement. Payouts in both the annual and long-term programs reflect rigorous performance goals.

| | Feedback from Our Investors Continues to Inform the Committee | | | •

IBM once again engaged withoffered year-round robust engagement to our stockholders, reaching out to over 100125 institutions and reached out to hundreds of thousands of individual registered and beneficial owners representingleading up to the 2023 Annual Meeting and then offering off-season engagement to stockholders owning more than 50%57% of the shares that voted on Say on Pay in 2020. | 2023. •

Our stockholder discussions and formal 20202023 Say on Pay vote reaffirmed investor support of our pay practices. | |

342024 Notice of Annual Meeting & Proxy Statement | 2023 Compensation Discussion and Analysis

| | | 34 | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis |

Section 1: Executive Compensation Program Design and Results Trust and personal responsibility in all relationships — relationships with clients, partners, communities, fellow IBMers, and investors — is a core value at IBM. As a part of maintaining this trust, we well understand the need for our investors — not only professional fund managers and institutional investor groups, but also millions of individual investors — to know how and why compensation decisions are made. | | | | To that end, IBM’s executive compensation practices are designed specifically to meet five key objectives: | | | | | •

Align the interests of IBM’s leaders with those of our investors by varying compensation based on both long-term and annual business results and delivering a large portion of the total pay opportunity in IBM stock; •

Balance rewards for both short-term results and the long-term strategic decisions needed to ensure sustained business performance over time; | | | •

Attract and retain the highly qualified senior leaders needed to drive a global enterprise to succeed in today’s highly competitive marketplace; •

Motivate our leaders to deliver a high degree of business performance without encouraging excessive risk taking; and •

Differentiate rewards to reflect individual and team performance. | | |

The specific elements of IBM’s current U.S. executive compensation programs are: | | Type | | | | Type

| | Component | | | Key Characteristics | |

| | | | Current Year

Performance | | | | Salary | | | Salary is a market-competitive, fixed level of compensation. | | | | | Annual Incentive Program (AIP) | | | At target, annual incentive provides a market-competitive total cash opportunity. Actual annual incentive payments are funded by business performance against financial metrics and distributed based on annual performance scores, with top performers typically earning the greatest payouts and the lowest performers earning no incentive payouts. | | | | | | | Long-Term

Incentive | | | | Performance Share Units (PSUs) | | Equity awards are typically granted annually and may consist of PSUs and RSUs. Equity

| Annual equity grants are based on competitive positioning and vary based on individual talent factors. Lower performers do not receive equity grants. For PSUs, the number of units granted can be increased or decreased at the end of the three-year performance period based on IBM’s performance against predetermined targets.In addition,targets and a relative performance metric applies to all PSU awards. The final number of PSUs earned can be increased or decreased based on IBM’s Return on Invested Capital (ROIC) performance relative to S&P indices.

metric. | | | | | Restricted Stock Units (RSUs) | | | RSUs vest over time; typically ratably over four years. | | | | | Stock Options | | Retention

| | Stock-Based Grants & Cash Awards | | Periodically,Stock Options vest over time; typically ratably over four years. The exercise price is at least the Compensation Committee and/or the Chairman and CEO reviews outstanding stock-based awards for key executives. Depending on individual performance and the competitive environment for senior executive leadership talent, awards may be made in the formvalue of Retention Restricted Stock Units (RRSUs), retention PSUs (RPSUs), premium-priced stock options or cash for certain executives. RRSU and RPSU vesting periods typically may range from two to five years. In addition to time-based vesting, RPSUs include a relative ROIC performance metric (consistent with standard PSUs) for some or all of a given award. Cash awards have a clawback if an executive leaves IBM before it is earned.

| | | | Other Compensation

| | Perquisites and Other Benefits | | Perquisites are intended to ensure safety and productivity of executives. Perquisites include such things as annual executive physicals, transportation, financial planning, and personal security.

| | | | Post Employment

| | Savings Plan

| | U.S. employees may participate in the IBM 401(k) Plus Plan by saving a portionstock price on the date of their pay ingrant, and will be exercisable for up to 10 years from the plan, and eligible employees may also participate in a non-qualified deferred compensation savings plan, which enables participants to save a portiondate of their eligible pay in excess of IRS limits for 401(k) plans. The Company provides matching and automatic contributions for both of these plans.

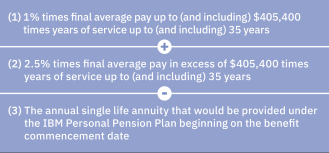

Named Executive Officers (NEOs) may have legacy participation in closed retention and retirement plans, for which future accruals ceased as of December 31, 2007.

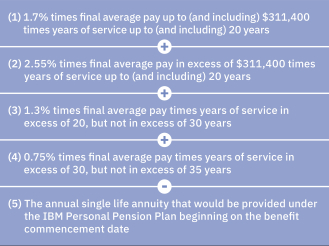

A full description of the Retention, Pension, and Non-Qualified Deferred Compensation plans is provided in this Proxy Statement, beginning with the 2020 Retention Plan Narrative.

| | grant. | | Non-qualified Savings Plan

| | | Pension Plans (closed)

| | | Supplemental Executive Retention Plan (closed)

| | | | | |

Other compensation elements include perquisites, which are used on a limited basis to ensure safety and productivity of executives, and retirement benefits.

Full Career Performance: Retention, Pension, and Savings:Periodically, awards may be made in the form of Retention Restricted Stock Units (RRSUs) or cash awards to help retain certain executives. Vesting of RRSUs typically range from two to five years and cash awards have a clawback if an executive leaves IBM before it is earned. | | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis | | 35 |

Eligible U.S. employees may participate in post-employment savings plans such as the IBM 401(k) Plus Plan, and a non-qualified deferred compensation plan. Effective January 1, 2024 the Company also provided a new cash balance retirement benefit in the IBM Personal Pension Plan to all eligible employees equal to 5% of eligible pay. In light of this change, the Company match and automatic contributions in the 401(k) Plan ended December 31, 2023; and effective January 1, 2024 employer contributions in the non-qualified deferred compensation savings plan moved to a consistent 5% matching contribution for all eligible employees.

2024 Notice of Annual Meeting & Proxy Statement | 2023 Compensation Discussion and Analysis 35

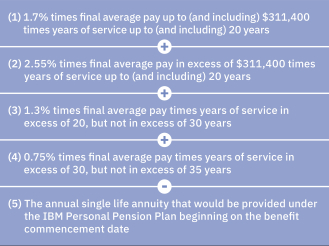

Our Incentive Compensation Design Supports our Business Strategy Our senior executive pay is heavily weighted to IBM’s performance through the annual and long-term incentive programs. Each year, the Committee ensures that these programs are closely aligned to the Company’s financial and strategic objectives and are appropriately balanced. Targets are set at challenging levels and are consistent with IBM’s financial model shared with investors for that year. As part of IBM’s ongoing management system, targets are evaluated to ensure they do not encourage an inappropriate amount of risk taking.For performance-based programs ending in 2020, IBM measured performance across six key financial metrics:

2023 Metrics and Weightings | | | Annual Incentive Program (AIP) | | | | | | | | IBM Revenue (20%)

| |

| | Operating Cash Flow* | | | | | | | | | | Measures total IBM revenue performance across the IBM portfolio of business | AIP

| | Operating Net Income (40%)

| |

| | Measures our profit and operational success

| | | | Operating Cash Flow* (40%)

| |

| | Important measure ofMeasures our ability to reinvest and return value to stockholders

shareholders | | | | | | Diversity Modifier: Affirms management’s commitment to diverse representation in our workforce that reflects the labor pool demographics of the communities in which we operate. | | |

| | | Performance Share Unit (PSU) Program(1) | | | | | | Revenue | | | | Operating EPS (70%)EPS* | |

| | Free Cash Flow* | | | | | | | | | | Measures revenue performance over three years | | | | | | | | Measures operating profitability on a per share basis | PSU

Program

over three years | | Free Cash Flow (30%)

| |

| | Important measure of

| | Measures our ability to reinvest and return value to stockholdersshareholders over multiplethree years | | | | | | ROIC Modifier

(beginning in 2018)

Performance adjusted by a relative Return on Invested Capital Modifier. | |

| | Reaffirms high value business model through a negative adjustment for ROIC below S&P 500 median, and a positive adjustment for ROIC above both the S&P 500 and S&P IT medians

|

*

Non-GAAP financial metrics. See Appendix A for information on how we calculate these performance metrics. (1)

For PSU performance period 2020-2022, the metrics included were Operating EPS at 70%, Free Cash Flow at 30%, and the ROIC Modifier. IBM shares its financial model each year with investors in the context of its long-term strategy. To provide further transparency, into the rigor of our goal setting process, IBM discloses the performance attainment against financial targets for the most recent performance period, for both the Annual Incentive Program and the Performance Share Unit Program.AIP and PSU Design Updates Beginning in 2021

To reinforce the strategic shift of the Company’s business model announced in October 2020, when IBM announced the spin-off of the Company’s managed infrastructure services business, and to support the focus on delivering sustainable revenue growth and free cash flow as a hybrid cloud and AI company, the Committee revamped the performance metrics in our executive compensation programs as follows:

2021 Metrics and Weightings

| | | | | | | | | IBM Revenue (50%)

| |

| | Increased focus on total IBM revenue performance across the IBM portfolio of business (weighting increased from 20%)

| AIP

| | Operating Cash Flow* (50%)

| |

| | Increased focus on our ability to reinvest and return value to stockholders (weighting increased from 40%)

| | | Diversity Modifier

New in 2021

| |

| | Reinforces senior management’s focus on improving a diverse representation of our workforce

| | | IBM Revenue (40%)

New in 2021

| |

| | Reinforces focus on cumulative IBM revenue performance over multiple years

| PSU

Program

| | Operating EPS (30%)

| |

| | Measures operating profitability on a per share basis (weighting reduced from 70%)

| | Free Cash Flow (30%)

| |

| | Continues to be an important measure of our ability to reinvest and return value to stockholders over multiple years (weighting maintained)

| | | ROIC Modifier

| |

| | Reaffirms high value business model through a negative adjustment for ROIC below S&P 500 median, and a positive adjustment for ROIC above both the S&P 500 and S&P IT medians

|

*Net | Cash from Operating Activities, excluding Global Financing receivables.

|

| | | 36 | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis |

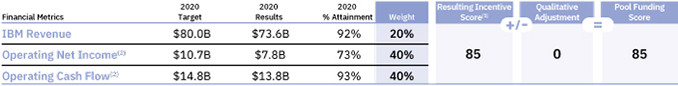

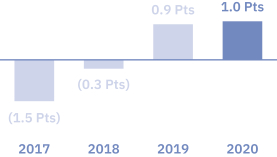

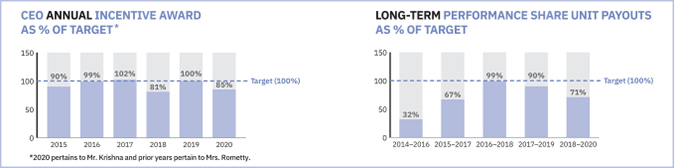

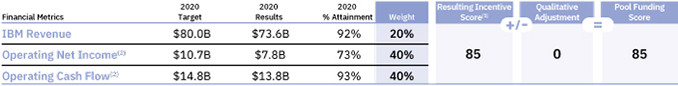

20202023 Annual Incentive Program

IBM sets business objectives at the beginning of each year, which are approved by the Board of Directors. The Compensation Committee and the Board of Directors review IBM’s annual business objectives and set the metrics and weightings for the annual incentive program to reflect current business priorities.(AIP). These objectives translate to financial targets for IBM and for each business unit for purposes of determining the target funding of the AIP. Performance against business objectivesthe targets determines the actual total funding pool for the year, which can vary from 0% to 200% of total target incentives for all executives. At the end of the year, performance for IBM is assessed against these predetermined financial targets, which are updated to remove any impact of currency movement or the change in tax rates, compared to plan.rates. The financial targets may be adjusted up or down for extraordinary events if recommended by the Chairman and CEO and approved by the Compensation Committee. For example, adjustments are usually made for large acquisitions and divestitures. For 2020, The diversity modifier affirms management’s commitment to diverse representation in our workforce that reflects the target was adjusted to exclude the impactlabor pool demographics of the $2.0 billion pre-tax chargescommunities in which we operate. A diverse workforce and an inclusive work environment fuel both innovation and creativity. The diversity modifier creates a common mechanism to align leaders with our commitment to creating an inclusive environment for structural actionsall. This modifier can result in a 5 point reduction, no impact, or 5 point increase to the AIP scoring. In 2023, the modifier was based on our progress in creating and developing a diverse executive population. Executive representation of women globally, as well as Black and Hispanic executives in the fourth quarter to simplifyUnited States, changed by +1.1 points, -0.2 points and optimize our operating model in support of+0.6 points, respectively for the announcement we made in our strategic update in October. Whileyear. In 2023, these results mean that the COVID-19 global pandemic had a significant impact on 2020 results, no adjustment was made to scoring due to COVID-19. The Committee determined that this approach best reflectedmodifier did not increase or decrease the stockholder experience in 2020. In addition,AIP scoring. Finally, the Chairman and CEO can recommend an adjustment, up or down, based on factors beyond IBM’s financial performance; this includes, for example, client experience, market share, growthresearch and diversityinnovation, and inclusion of IBM’s workforce. Although IBM made improvements in several non-financial areas in 2020, including record diversity across all representation groups,culture and engagement. Taking such matters into account for 2023, the Chairman and CEO did not recommend any qualitative increase onCompensation Committee approved an upward adjustment to the score given overall resultsof ten points reflecting progress in a challenging 2020 business environment.AI and quantum computing, IBM’s high performance culture, and employee engagement. The Compensation Committee reviews the financial scoring, diversity modifier, and proposed qualitative adjustments, and approves the final AIP funding level. 362024 Notice of Annual Meeting & Proxy Statement | 2023 Compensation Discussion and Analysis

Once the total pool funding level has been approved, payouts for each executive are calculated using an Individual Contribution Factor (ICF). The ICF is determined by evaluating individual performance against predetermined business objectives. As a result, a lower-performing executive will receive as little as zero payout and the most exceptional performers (excluding the Chairman and CEO) are capped at three times their individual target incentive (payoutsincentive. Payouts at this level are rare and only possible when IBM’s performance has also been exceptional).exceptional. The AIP, which covers approximately 5,0004,000 IBM executives, includes this individual cap at three times the individual target to ensureallow for differentiated pay for performance. For the Chairman and CEO, the cap is two times target. An executive generally must be employed by IBM at the end of the performance period in order to be eligible to receive an AIP payout. At the discretion of appropriate senior management, the Compensation Committee, or the Board, an executive may receive a prorated payout of AIP upon retirement. AIP payouts earned during the performance period are generally paid on or before MarchApril 15 of the year following the end of such period.

![[MISSING IMAGE: fc_indicon-pn.jpg]](/files/DEF 14A/0001104659-24-032641/fc_indicon-pn.jpg) This incentive design ensures payouts are aligned to IBM’s overall business performance while also ensuring individual executive accountability for specific business objectives.2020

Based on full year financial performance against total IBMof revenue operating net income, and operating cash flow, the weighted incentiveIBM pool funding score was 85.

(1) | Based on AIP payout table.

|

(2) | Non-GAAP financial metrics. See Appendix A for information on how we calculate these performance metrics.

|

117. (1)

Based on AIP payout table; the 2023 leveraged score resulted in 98% for Revenue and 116% for Operating Cash Flow; for Revenue, threshold attainment is 80% with a 50% payout, target attainment and payout is 100%, maximum attainment is 110% with a 200% payout; for Operating Cash Flow, threshold attainment is 70% with a 70% payout, target attainment and payout is 100%, maximum attainment is 120% with a 200% payout. (2)

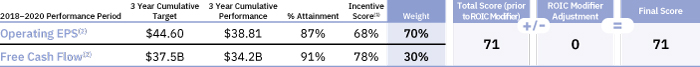

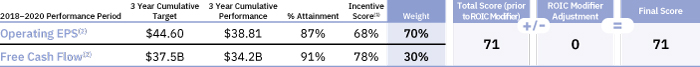

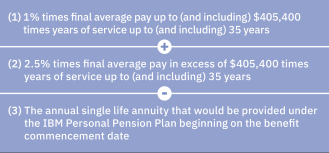

Operating Cash Flow is a non-GAAP financial metric. See Appendix A for information on how we calculate this performance metric. Performance Share Unit Program The Performance Share Unit (PSU) metrics for the 2018–20202021-2023 performance period were Revenue, Operating EPS, and Free Cash Flow, unchanged from previous years. Flow.

| | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis | | 37 |

TargetsFinancial targets are established at the beginning of each three-year performance period. Both Operating EPS and Free Cash Flow cumulative three-year targets for the 2018-2020 performance period exceeded those cumulative three-year targets for the previous performance period (2017-2019). These targets are based on IBM’s financial model, as shared with investors, and the Board-approved annual budget. business objectives.

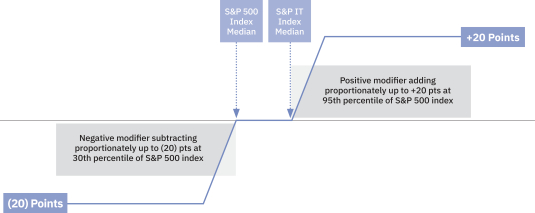

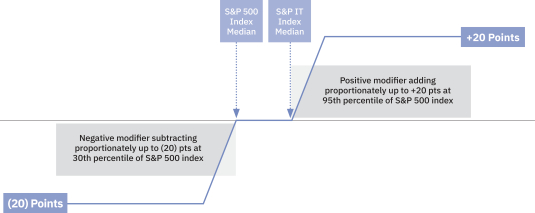

As discussed in prior years, in connection with the separation of Kyndryl in 2021, the Committee approved adjustments to the 2021-2023 PSU program targets in December 2021. The Committee’s longstanding practice is that the Company’s share repurchase activities have no effect on executive compensation. Actual operatingOperating EPS results and the target are adjusted to remove the impact of any difference between the actual share count and the budgetedtargeted share count, while simultaneously ensuring that executive compensation targets are normalizedcount. Revenue is adjusted for any planned buybacks that are incorporated into the Operating EPS target.fluctuations in foreign currency rates in all three years. Additionally, the scoring for the PSU Program takes into accountmay consider extraordinary events. For the 2018-20202021-2023 performance period, 2022 and 2023 results arewere adjusted to exclude the impact of the Red Hat acquisition. This approach is consistent with the adjustment made to the previous performance period (2017-2019). For 2018-2020, results were also adjusted to exclude the impact of the $2.0 billion pre-tax charges for structural actionsexiting our business in the fourth quarter to simplify and optimize our operating model in support of the announcement we made in our strategic update in October. While the COVID-19 global pandemic had a significant impact on the 2018-2020 results, there was no adjustment made to scoring due to COVID-19. The Committee determined that this approach best reflected the stockholder experience in 2020.Russia. At the end of each three-year performance period, the Compensation Committee approves the determination of actual performance relative to pre-established financial targets and the number of PSUs are adjusted up or down from 0% to 150% of targets, based on the approved actual performance. In addition, beginning with the 2018-2020 PSU Program has a Relative Return on Invested Capital (ROIC) modifier was added to the PSU program.modifier. The modifier is based on IBM’s ROIC performance over the three-year performance period, relative to the S&P 500 Index (excluding financial services companies due to lack of comparability) and the S&P Information Technology Index. This modifier reduces the score up to 20 points when performance falls below the S&P 500 Index median and increases the score up to 20 points when IBM exceeds the median performance of both the S&P 500 Index and the S&P Information Technology Index. The modifier has no impact when IBM’s ROIC performance falls between the S&P 500 Index median and the S&P Information Technology Index median. There is no qualitative adjustment to the PSU program score. RELATIVE ROIC MODIFIER

2024 Notice of Annual Meeting & Proxy Statement | 2023 Compensation Discussion and Analysis 37

The PSU score is calculated as a weighted average of results against targets for Revenue (40%), Operating EPS (70%(30%) and Free Cash Flow (30%). The calculation for the 2018-20202021-2023 performance period is shown in the table below. For the 2018-20202021-2023 performance period, the ROIC modifier was zero.0%. While IBM ROIC was atexceeded the 68th percentilemedian of the S&P 500 Index (excluding financial services), it did not exceed the median of the S&P Information Technology Index.

(1) | Based on PSU payout table.

|

(2) | Non-GAAP financial metrics. See Appendix A for GAAP to Non-GAAP reconciliation.

|

| Targets and scoring exclude the impact of the Red Hat acquisition and the $2B charge for Q4 2020 structural actions.

|

Impact of Significant One-Time Events on the Open PSU Performance Periods

As previously disclosed, in connection with the July 9, 2019 closing of the Red Hat acquisition, the 2019-2021 PSU program targets incorporate Red Hat performance. The target updates resulted in an increase to the Free Cash Flow target and a reduction to the Operating EPS target, almost entirely driven by a non-cash purchase accounting adjustment to deferred revenue required by US GAAP. The updated targets were higher than external guidance shared with stockholders at IBM’s Investor Briefing on August 2, 2019.

Cumulative three-year EPS and Cash Flow targets for the 2019-2021 and 2020-2022 Performance Share Unit (PSU) programs were set prior to the announcement of the planned 2021 spin-off of the managed infrastructure services business and related actions. IBM’s PSU programs consist of operational financial metrics that were substantially impacted by this significant unplanned event.

| | | 38 | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis |

(1)

For the 2019-2021 and 2020-2022 PSU programs, the Committee determined that the targets for these two outstanding PSU programs were no longer reflective of the company’s strategic direction and growth objectives as communicated to stockholders over the past year. The Committee approved an adjustment reducing the targets for the 2019-2021 and 2020-2022 PSU programs, incorporating the planned 2021 spin-off of the managed infrastructure services business including one-time transaction-related cash charges associated with the spin, and actions taken to enable the separation of NewCo and IBM’s growth strategy under current market conditions. The resulting targets remain rigorous and will continue to appropriately incent management in an important period. Consistent with the Company’s long-standing practice of setting rigorous performance plans, cumulative targets for both plans remain higher than comparable metrics shared with investors on January 21, 2021.

Unique Compensation Arrangements for James Whitehurst

In Mr. Whitehurst’s prior role as Chief Executive Officer of Red Hat, a portion of his 2020 compensation includes payments provided as a result of his participation in the following Red Hat compensation and benefit programs, as well as acquisition related agreements between IBM and Mr. Whitehurst, all of which existed prior to the close of the Red Hat acquisition on July 9, 2019.

Restricted Stock Awards

Mr. Whitehurst’s unvested Red Hat equity awards were converted into Restricted Stock Awards (RSAs) to receive IBM stock upon close of the Red Hat acquisition, at the same rate of conversion that was used to convert all of Red Hat’s outstanding stock into IBM stock.

Cash-Based Retention

As disclosed in the Merger Proxy Statement filed by Red Hat, Inc. with the SEC on December 12, 2018, in connection with the merger agreement between Red Hat and IBM, Mr. Whitehurst entered into a retention arrangement with IBM providing that Mr. Whitehurst shall be entitled to a $6M retention cash payment, with $2M paid on each of the 1st, 2nd, and 3rd anniversaries of the closing of the merger, respectively, subject to continued employment by IBM and accomplishment of key milestones for each of the three years.

The Committee approved the first $2M payment for Mr. Whitehurst in July 2020, in connection with the first anniversary of the closing of the merger. This payment was based on Mr. Whitehurst’s accomplishment of financial goals in delivering Red Hat revenue, pre-tax income and free cash flow, as well as increasing the number of clients utilizing IBM or Red Hat cloud container offerings, expanding Red Hat’s strategic partnerships, and successfully retaining key Red Hat talent in the first year following the closing of the merger.

Red Hat Annual Cash Bonus

Upon the close of the Red Hat acquisition, IBM adopted Red Hat’s Annual Cash Bonus Plan (ACB Plan) for Red Hat’s fiscal year 2020 (i.e., March 1, 2019 to February 29, 2020). As CEO of Red Hat, Mr. Whitehurst participated in this ACB Plan. Red Hat’s ACB Plan allowed for payouts from 0% - 200% of target incentive, based on accomplishment of Red Hat’s fiscal year financial performance (75% of payout) and performance against individual goals (25% of payout). For fiscal 2020, financial performance metrics included Red Hat’s Total Revenue, Cash from Operations, and Non-GAAP operating margin*, which were each weighted equally during this period.

Based on 166% achievement of the Plan’s financial performance metrics and 105% of Mr. Whitehurst’s individual goals, the Committee approved a payment of $2,487,375, or 150.75% of Mr. Whitehurst’s target bonus for this time period. A pro-rata portion of his total payment is included in the 2020 Summary Compensation Table, to reflect the amount earned for January and February of 2020. Effective March 1, 2020, Mr. Whitehurst became a participant of IBM’s Annual Incentive Program and was no longer a participant of Red Hat’s ACB Plan. *PSU payout levels displayed below.

(2)

Non-GAAP financial metric. See Appendix A for information on how we calculate this performance metric.New

(3)

2021-2023 Revenue result is calculated using historical 2021 consolidated revenue, including ten months of Kyndryl discontinued operations revenue, and 2022 and 2023 revenue as reported, adjusted for 2020: Mr. Whitehurst’s retention Performance Share Unit (RPSU) AwardIn 2020,fluctuations in foreign currency and impacts of separating business in Russia.

(4)

Non-GAAP financial metrics. 2021-2023 Operating EPS result is calculated based on 2021 historical as reported amounts adjusted to include discontinued operations. Operating EPS excludes certain separation related charges in 2021 and includes immaterial share adjustments in all three years. For 2022 and 2023, both Operating EPS and Free Cash Flow were adjusted to exclude the Committee approved an RPSU grantimpact of $15Mseparating business in planned valueRussia. Free Cash Flow amounts are on a consolidated basis, which includes activity from discontinued operations. See Appendix A for Mr. Whitehurst, which was awardedGAAP to non-GAAP reconciliation. 2021-2023 PSUs: Threshold, Target, and Max Attainment % and Payout %: | | | | | Threshold | | | Target | | | Max | | | | Financial Metrics | | | Attainment % / Payout % | | | Attainment % / Payout % | | | Attainment % / Payout % | | | | Revenue (40%) | | | 70% / 25% | | | 100% / 100% | | | 120% / 150% | | | | Operating EPS (30%)(1) | | | 70% / 25% | | | 100% / 100% | | | 120% / 150% | | | | Free Cash Flow (30%)(1) | | | 70% / 25% | | | 100% / 100% | | | 120% / 150% | |

(1)

Non-GAAP financial metrics. See Appendix A for information on March 2, 2020, prior to undertaking his role as IBM President. The RPSU was awarded as consideration for signing an IBM Non-Competition agreement (NCA). This NCA is broader than the non-competition provisions Mr. Whitehurst agreed to in connection with the acquisition of Red Hat, which limited competition within the then-existing scope of Red Hat’s business. The IBM NCA covers the scope of IBM’s business footprint, and aligns his NCA terms and conditions with other IBM leaders.One-third of the RPSU will vest and pay out on July 31, 2021, with no additionalhow we calculate these performance criteria. Two-thirds of the RPSU will vest and pay out on July 31, 2023; the number of units that pay out for this portion of the award is subject to the following performance criteria:

metrics. The relative ROIC modifier (previously described) that applies to PSUs for the 2020-2022

Note: For PSU performance period may also modify2020-2022, the number of units paid for this portion of the award up or down by up to 20 points, based on IBM’s ROIC performance relative to broader market indices. As a result, the minimum number earned for this portion of the RPSU could be as low as 80% of target,metrics included were Operating EPS at 70%, Free Cash Flow at 30%, and the maximum number earned could be up to 120%ROIC Modifier.

382024 Notice of target.Annual Meeting & Proxy Statement | 2023 Compensation Discussion and Analysis

| | | 2021 Notice of Annual Meeting & Proxy Statement | 2020 Compensation Discussion and Analysis | | 39 |